Governance of pension providers

A typical feature of the governance of earnings-related pension providers is that both the policyholders (employers) and the insured (employees) are represented in the administrative structures. The systems of governing the various types of pension providers have both similarities and differences. The Acts pertaining to each pension provider lay down provisions on their governance and on the tasks of various administrative bodies.

Content of this page

On governance in general

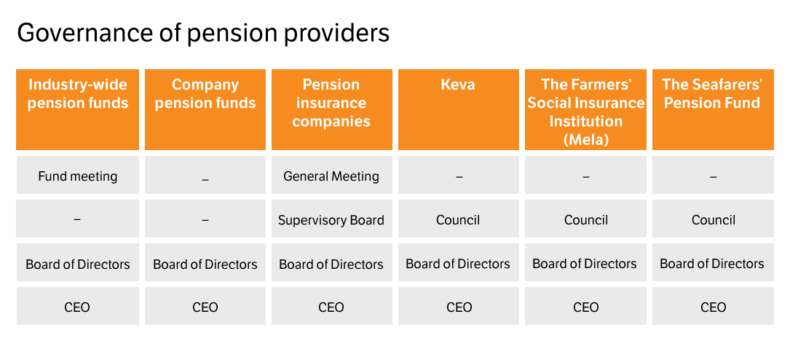

The number of administrative levels ranges from two in company pension funds to four in pension insurance companies. The table below shows the administrative bodies of the various types of earnings-related pension providers:

The administrative levels shared by all types of earnings-related pension providers are the Board of Directors and the CEO (the Administrator in company pension funds).

Typically, the Board of Directors of an earnings-related pension provider has the following tasks:

- responsibility for the administration and the proper organization of activities;

- making decisions about the pension provider’s investment plan;

- arranging and supervising accounting and asset management.

The CEO (the Administrator in company pension funds) is typically responsible for the pension provider’s day-to-day administration. The CEO (the Administrator in company pension funds) is appointed by the Board of Directors.

Persons in the administration bodies of authorized pension providers must typically meet certain eligibility and qualification requirements defined by law. Often these requirements concern, in particular, the Chair and Vice Chair of the Board of Directors or the management in general.

Special features in the governance of the various types of earnings-related pension insurers are discussed in the following sections.

Industry-wide pension funds

The governance of industry-wide pension funds is regulated by the Act on Company Pension Funds and Industry-wide Pension Funds.

The highest decision-making organ of an industry-wide pension fund is the Fund Meeting, attended by both the insured (employees) and the shareholders (employers). The Fund Meeting may decide only on matters prescribed for it by law, such as

- adoption of the income statement and the balance sheet;

- discharging the Board members and the CEO from liability;

- amending the fund by-laws.

The Fund Meeting also elects the Board of Directors. The by-laws of the fund may provide that employers have the right to select a maximum of half of the Board members. Employers are not allowed to participate in the election of other Board members.

If the by-laws of the pension fund so provide, instead of the Fund Meeting, the highest decision-making power may be exercised by the representatives elected by the fund employees and employers, who constitute the Assembly of Representatives of the pension fund. If the pension fund has an Assembly of Representatives, the provisions concerning the Fund Meeting shall apply to its meetings.

The Assembly of Representatives has at least six members. The same person may not be a member of both the Assembly of Representatives and the Board of Directors simultaneously.

An industry-wide pension fund’s Board of Directors has at least four members and at least two deputy members. Employees select at least two members and one deputy member to the Board. Employers select all other members to the Board.

If, in keeping with the fund’s by-laws, the Board has more than four members, it must be ensured that the ratio between the Board members representing the employer and those representing the employees corresponds to the above ratio reasonably well.

The Chairperson of the Board is elected by the Board from among its members. The CEO of the industry-wide pension fund or the Principal Actuary may not serve as the Chairman.

The Board of Directors of the industry-wide pension fund must manage the company professionally, in accordance with sound and prudent operating principles and in keeping with the principles concerning reliable administration.

Board members must be of good repute and must have good knowledge of earnings-related pension insurance operations. In addition, the Board must have solid expertise of investment operations.

The CEO must manage the industry-wide pension fund professionally, in accordance with sound and prudent operating principles and in keeping with the principles concerning reliable administration.

In addition, the governance structure of an industry-wide pension fund may include a Supervisory Board if a provision in the fund’s rules referred to such a board at the date of entry into force of the current Act on Company Pension Funds and Industry-wide Pension Funds. One industry-wide pension fund’s rules contain such a provision. The duties of that fund’s Supervisory Board correspond to those assigned to the Supervisory Boards of pension insurance companies.

Company pension funds

The governance of company pension funds is regulated by the Act on Company Pension Funds and Industry-wide Pension Funds.

In a company pension fund, the highest decision-making power rests with the Board of Directors. The Board has at least five members and at least two deputy members.

The employees insured with the fund select among themselves at least two members and one deputy member to the Board.

The employer selects the rest of the Board members and deputy members.

If, in keeping with the fund’s by-laws, the Board has more than five members, it must be ensured that the ratio between the Board members representing the employer and those representing the employees corresponds to the above ratio reasonably well.

The Board elects its Chairperson. The Chairperson may not serve as the pension fund’s CEO or Principal Actuary.

The Board of Directors of the company pension fund must manage the pension fund professionally, in accordance with sound and prudent operating principles and in keeping with the principles concerning reliable administration.

The Board members must be of good repute and must have good knowledge of earnings-related pension insurance operations. In addition, the Board must have solid expertise of investment operations.

The CEO must manage the company pension fund professionally, in accordance with sound and prudent operating principles and in keeping with the principles concerning reliable administration

Pension insurance companies

The governance of pension insurance companies is regulated by the Act on Earnings-Related Pension Insurance Companies.

General MeetingIn a pension insurance company, the highest decision-making power rests with the General Meeting. The General Meeting elects the Supervisory Board and decides on the remuneration of its members. The General Meeting also adopts the pension insurance company’s income statement and balance sheet and discharges the Supervisory Board, the members of the Board of Directors and the CEO from liability.

The Supervisory Board is elected by the General Meeting. By law, the Supervisory Board must have representatives of both the policyholders (employers) and the insured (employees), who are elected among candidates proposed by the principal central organizations representing employers and wage earners. The representatives of wage earners must account for at least one third of all Supervisory Board members. Employers’ representatives, on the other hand, must account for at least one sixth of all Supervisory Board members.

The members of the Supervisory Board may not sit on the Supervisory Board or Board of Directors of another pension insurance company.

The Supervisory Board elects a Chair and a Vice Chair from among its members. One of them must be a person proposed by the representatives of wage earners. The Articles of Association may also stipulate that the General Meeting elects the Chair and a Vice Chair of the Supervisory Board.

The Supervisory Board’s tasks include the following:

- election of the members of the pension insurance company’s Board of Directors;

- confirmation of the remunerations paid to the members of the Board of Directors;

- supervision of the company’s administration under the responsibility of the Board of Directors and the CEO.

The Supervisory Board may not be given any other tasks or the right to represent the company.

The Board of Directors of a pension insurance company must have at least three members.

In the same way as the Supervisory Board, the Board of Directors must also have representatives of both the policyholders (employers) and the insured (employees), who are elected among candidates proposed by the principal central organizations representing employers and wage earners. Since the beginning of 2020, the representatives of wage earners must account for at least one third of all Board members, and at least one sixth of the employers’ representatives.

The members of the Board of Directors may not sit on the Supervisory Board or Board of Directors of another pension insurance company.

The Board members shall be of good repute and they must have good knowledge of the earnings-related pension insurance system. The Board of Directors must also have a good understanding of investment.

The Board of Directors and the CEO of a pension insurance company must manage the company professionally, in accordance with sound and prudent business principles and in keeping with the principles concerning reliable administration.

The Board of Directors elects a Chair and a Vice Chair from among its members. One of these must be a person proposed by the representatives of wage earners. The Articles of Association may also stipulate that the Supervisory Board elects the Chair and a Vice Chair of the Board of Directors.

The CEO of a pension insurance company must be of good repute and must have solid knowledge of earnings-related pension insurance, investment, and business management.

The CEO may not have a seat on the same company’s Supervisory Board or Board of Directors or work as the company’s principal actuary. Nor may the CEO sit on the Supervisory Board or Board of Directors of another pension insurance company.

Keva

The governance of Keva is regulated by the Keva Act.

The highest decision-making organ in Keva is the Council, whose members are appointed by the Ministry of Finance for a term of four years at a time (municipal electoral period).

The Council is comprised of 30 members, each of whom has a personal deputy member. By law, six regular members and six deputy members of the Council are appointed upon the proposal of the main municipal negotiating organizations, four based on a proposal by Local Government Employers KT and the rest are appointed upon the proposal of the Association of Finnish Local and Regional Authorities. When making its proposal, the Association of Finnish Local and Regional Authorities must take into account the municipal election result.

The Council is responsible, among other things, for the following:

- supervise the administration and operation of Keva;

- electing the members and deputy members of the Board of Directors;

- deciding on the grounds for fees and other remuneration paid to holders of positions of trust deciding on the contributions paid by the member organizations;

- discussing the financial statements and the auditor’s report, deciding on the adoption of the financial statements and on the discharge from liability;

- approving the next year’s budget as the general economic guideline and approving the operating and financial plan for the next three or more years.

The Council elects the Board of Directors for a term of two years at a time. The Board is comprised of eleven members, each of whom has a personal deputy member. Three Board members and their deputy members must be elected from among persons proposed by main municipal negotiating organizations. Two Board members and their deputy members are elected based on a proposal by Local Government Employers KT and the rest are appointed upon the proposal of the Association of Finnish Local and Regional Authorities.

The Chair and Vice Chair of the Board are appointed by the Council.

The Board of Directors is responsible for the general supervision and steering of Keva’s operations. In addition, the Board decides on the plan concerning the investment of pension assets and discusses other issues that are important as matters of principle or that have far-reaching consequences for investment.

The Board members shall be of good repute and they must have good knowledge of the earnings-related pension insurance system. The Board of Directors must also have a good understanding of investment.

In addition, the Board of Directors and the CEO must manage Keva professionally, taking into account the purpose of Keva’s operations and in accordance with the principles of good governance.

The CEO is responsible for Keva’s operations and finances. The CEO has two deputies, whose principal areas of responsibility are decided by the Board of Directors. Both the CEO and the Deputy CEOs have a public-service employment relationship.

The eligibility requirements for the position of CEO and Deputy CEO are a master’s degree, the diverse experience required by the position, and managerial skills and experience demonstrated in practice.

An executive employment contract may be signed with the CEO.

The Farmers’ Social Insurance Institution (Mela)

The governance of Mela is regulated by the The Farmers’ Pensions Act and Government Decree.

Mela’s highest decision-making power is vested in the 15-member Council, which is appointed by the Finnish Centre for Pensions.

The Chairperson of the Council is nominated by the Central Union of Agricultural Producers and Forest Owners (MTK) and the Vice Chair is nominated by the Finnish Centre for Pensions. Ten of the Council members represent the principal organizations looking after the financial interests of people insured with Mela. In addition, the Council has a member from the Ministry of Agriculture and Forestry, a member from the Ministry of Social Affairs and Health and a member from the Ministry of Finance. With the exception of the Chair and the Vice Chair, each Council member has a personal deputy.

The Chair or the Vice Chair must have good knowledge of earnings-related pension insurance.

Among other things, the Council

- decides on the general guidelines for Mela’s operations;

- supervises the activities of the Board of Directors;

- elects the members and deputy members of the Board of Directors, with the exception of the representatives of the Ministries;

- elects the auditor;

- discusses the financial statements, the report on operations and the auditor’s report and decides on any measures that these may warrant.

Mela’s Board of Directors has nine members. The Finnish Centre for Pensions elects the Chair and Vice Chair of Mela’s Board of Directors; of these, the Chair represents the Central Union of Agricultural Producers and Forest Owners (MTK) and the Vice Chair represents the Finnish Centre for Pensions.

Mela’s Council elects four Board members who represent the principal organizations looking after the financial interests of people insured with Mela. In addition, the Board has a member from the Ministry of Agriculture and Forestry, a member from the Ministry of Social Affairs and Health and a member from the Ministry of Finance. With the exception of the Chair and the Vice Chair, each Board member has a personal deputy.

The Chair or the Vice Chair of the Board must have good knowledge of earnings-related pension insurance. For their part, Board members must be of good repute. In addition, the Board must be well acquainted with the pension provider’s operations and must have expertise in investment.

Among other things, the Board of Directors

- is responsible for Mela’s internal control and risk management system;

- makes decisions on issues pertaining to the Mela coverage;

- gives opinions and develops matters within its sphere of responsibilities;

- appoints and discharges Mela’s CEO and other senior executives.

The CEO of Mela must be of good repute. In addition, the CEO must have good knowledge of earnings-related pension insurance, other activities of the pension institution, investment and business management.

The Seafarers’ Pension Fund

The governance of the Seafarers’ Pension Fund is regulated by the Seafarers’ Pensions Act.

The highest decision-making power in the Seafarer’s Pension Fund is vested in the Council comprised of 13 members and their personal deputies. The Ministry of Social Affairs and Health appoints the Council for a term of three years at a time.

Two of the Council members represent the Ministry of Social Affairs and Health and one the Ministry of Transport and Communications. Of the remaining members, five represent employers and five represent employees. Of the employee representatives, one represents the crew, one deck officers, and one engineering officers.

The members representing employers and employees are nominated on the basis of proposals made by the organizations in the field.

The Ministry of Social Affairs and Health appoints one Council member to serve as the Chairperson and one to serve as the Vice Chair.

The Council members must have knowledge of shipping, insurance or investment. In addition, the Chair or the Vice Chair of the Council must have good knowledge of earnings-related pension insurance.

A person cannot simultaneously be a member of the Council and a member of the Board of Directors.

The Council decides on the general principles followed in the operations of the Seafarer’s Pension Fund and supervises the activities of the Board of Directors and the CEO. In addition, the Council is responsible for the following:

- adopting the Fund’s financial statements and report on operations as well as the auditor’s report;

- electing the auditor and deputy auditors, if any;

- determining the remunerations paid to the members and deputy members of the Board and to the auditors.

The Ministry of Social Affairs and Health appoints the Board of Directors of the Seafarer’s Pension Fund. The Board consists of five members and five personal deputy members.

A member designated by the Ministry serves as the Chairperson and, simultaneously, as a representative of the State. The Chairperson’s deputy serves as the Vice Chair.

Two of the other Board members represent employers, while two represent employees. Of the two employee representatives, one represents the crew and the other represents officers. The member representing officers is appointed for a calendar year at a time so that deck officers and engineering officers have a seat on the Board in alternate years.

The representatives of employers and employees are nominated on the basis of proposals made by organizations in the field.

Board members must be of good repute. In addition, the Board must have solid expertise of the shipping sector and investment. The Chair and the Vice Chair of the Board must have good knowledge of earnings-related pension insurance.

Among other things, the Board of Directors of the Seafarer’s Pension Fund

- decides on the investment of the Fund’s assets;

- gives opinions and makes proposals in matters pertaining to seafarers’ pension provision and its development;

- appoints the CEO and other executives of the Seafarer’s Pension Fund;

- manages the duties that have been assigned to the Board in the Act on reducing the solvency limit and covering the technical reserves of the pension provider.

The CEO of the Seafarers’ Pension Fund must be of good repute. In addition, the CEO must have good knowledge of earnings-related pension insurance, investment and business management.