Responsible investment of earnings-related pension assets

The basic task of pension providers is to secure earnings-related pensions for the current and future generations. One element of this task is investing pension assets. Responsibility has long been the mainstream of investment, and this is the case also for authorized pension providers’ investment activities. A wide range of tools is available for responsible investment. Systematic use of responsibility information is the principal way to implement responsible investment. In addition, responsible investment includes participation in various international responsibility commitments and cooperation projects. According to our analysis, the majority of earnings-related pension assets have been invested responsibly. Most of the assets are involved in various international commitments.

Content of this page

- Responsible investment is about caring for the environment, social responsibility and good governance

- UN-backed Principles for Responsible Investment as the base

- Influential international projects and investor cooperation as part of responsible investment

- Metrics and reporting commitments also have an impact

- Summarized results of the analysis

- Learn more about responsible investment by pension providers

- Basic information about the analysis

Responsible investment is about caring for the environment, social responsibility and good governance

The investment activities of pension providers are strongly regulated by law. Responsible investment is natural for pension providers, as the law requires that assets be invested productively and securely. The timeline for earnings-related investment is long, as the investment secures the financing of earnings-related pensions for decades to come. Responsible investment, for example in terms of climate and environmental sustainability, can therefore be seen as an aspect of security. Systematic consideration of responsibility factors in investment activities helps in investment risk management.

Responsibility is based on taking into account the so-called ESG factors — the environment, social responsibility and good governance — in all investments. This also applies to pension providers. These ESG factors include how well a company cares for its environmental responsibility, how it pays attention to human rights and employee rights, and how well it adheres to the principles of good governance.

Responsible investment is at the heart of the pension providers’ responsibility work. It is a question of common principles, but there is no single way to implement responsible investment. Each pension provider assesses responsibility from its own point of view and implements responsible investment on the basis of its own strategies.

Responsible investment can be implemented in many different ways, one of them usually being ESG integration, i.e. the systematic use of ESG data in investment analysis and decision-making, favouritism, exclusion, active ownership and influence, and thematic investments. The principles of responsible investment supported by the UN provide a comprehensive basis for responsible investment internationally.

Responsible investment now highlights the importance of active ownership. This means seeking to influence the companies where investments are made. If efforts to exert influence do not have the desired effect, the last alternative is to give up the investment. Companies that manufacture nuclear weapons and tobacco, for instance, are often excluded from investment on ethical grounds.

Commitment to international responsibility projects is one way for pension providers to make responsible investments. Pension providers have signed many commitments and are involved in various initiatives, projects and cooperation bodies that promote responsible investment. Commitment is also required from external asset managers used in investment activities. International commitments for metrics and reporting are also a way to make an impact. Especially in Finland, companies are also influenced directly through dialogue and voting at general meetings.

UN-backed Principles for Responsible Investment as the base

The responsible investment of earnings-related pension assets is based on the responsible investment principles backed by the UN. The principles mean that investment activities are committed to caring for the environment, social responsibility and good governance — the ESG factors described above. ESG data are utilized systematically when making investment analyses and decisions. Commitment to the principles means that accountability is also required of external asset managers. The principles constitute the responsible investment framework guiding pension providers’ responsible investment at many levels and from various perspectives, which is then refined by other means of responsible investment.

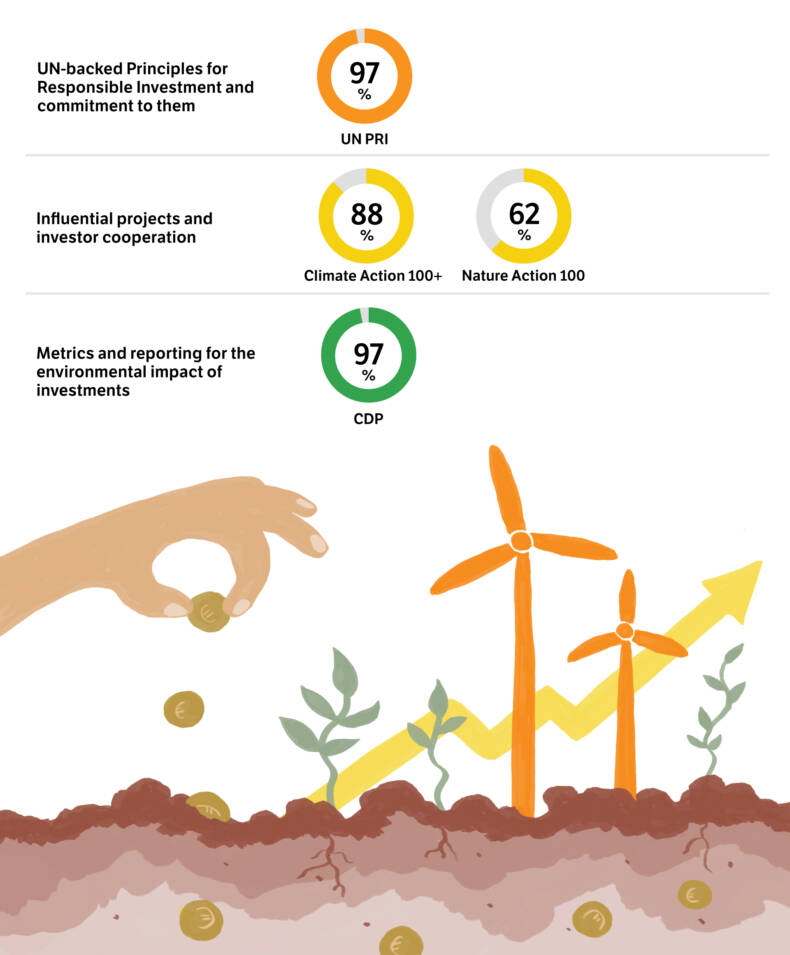

Almost all pension assets are invested in accordance with the UN Principles for Responsible Investment. At least 97 per cent of earnings-related pension assets have been invested in line with the framework of principles. Most pension providers have signed the commitment at the turn of the 2010s. In addition, some of the assets are included in the commitment through the external asset managers used in the investment.

As signatories to the principles, pension providers are committed to

- integrate ESG issues into investment processes

- act as active owners and incorporate ESG issues into their ownership policies

- promote proper ESG reporting of their investments

- promote the introduction of responsible investment principles in the investment sector

- promote responsible investment in cooperation with other investors

- report on their activities and on the progress of responsible investment.

UN PRI, the name of the framework in English, is derived from the words Principles for Responsible Investment. The principles were launched in 2006.

Influential international projects and investor cooperation as part of responsible investment

In addition to the UN PRI framework, pension providers promote responsible investment by influencing investments directly or through a project. Especially when the scale of investments is global, pension providers impact on investments through influential international projects and commitments. The investments of pension providers are globally diversified and include thousands of companies, either through direct ownership or through funds. For this reason, active ownership is implemented through institutional investors’ shared projects that allow investors to join forces in order to influence companies.

In our analysis, we examine two commitments which focus on climate change and biodiversity loss. At least 88 per cent of pension assets fall within the scope of the Climate Action 100+ initiative. The aim of Nature Action 100 is to increase corporate action to reverse the decline in biodiversity. At least 62 per cent of pension assets fall directly or indirectly under the scope of this initiative.

Launched in 2018, the Climate Action 100+ project, initiated in 2015 under the Paris Climate Agreement, is a major investor-gathering initiative that engages companies in dialogue on the climate agenda. In line with the name 100+, the project focuses on one hundred of the world’s largest greenhouse gas emitters — companies which account for two-thirds of annual industrial emissions worldwide. The project actively seeks to contribute to the development of companies that are more environmentally friendly. By participating in the project, earnings-related pension providers can influence the operations of these large companies that have significant environmental impacts.

The project involves more than 700 institutional investors from dozens of countries, managing a total of more than USD 60 trillion in investment assets.

Nature Action 100 is an international investors’ initiative which aims to raise companies’ ambition and action to reverse biodiversity loss. This initiative commits companies in key industries to action towards ending the decline in biodiversity by 2030.

It brings together over 200 international institutional investors, which in total manage over USD 28 billion in investment assets.

In addition to the IIGCC, there are many other international and cross-border investor cooperation forums. The forum for responsible investment in Finland is Finsif, which promotes networking and information gathering on issues related to responsible investment.

Founded in 2010, Finsif has almost 100 member organizations. Most authorized pension providers are members of Finsif.

Metrics and reporting commitments also have an impact

Alongside the UN-backed responsibility principles and projects aiming to exert influence and increase cooperation, pension providers implement responsible investment by promoting metrics and reporting on environmental impacts. Most often these are international metrics and reporting projects. Requiring reporting encourages companies and other organizations to reduce their carbon footprint and other environmental impacts and also, for instance, promotes the related regulation. This has an effect both on companies in which investments are made and on the corporate world at large. Authorized pension providers use information when planning responsible investment.

Measuring and reporting environmental impacts are the first steps in outlining the responsibility of investments and monitoring developments. Standardization of metrics and reporting makes it possible to prepare for a low-carbon future. The issues to be measured are the absolute carbon footprint of equity, fixed-income and real estate investments, as well as the carbon intensity of a particular investment in relation to its industry benchmark.

A significant share of the earnings-related pension assets is involved in projects for metrics and reporting. At least 97 per cent of the assets are involved as investor-signatories to CDP reporting, i.e. supporting the spread of the reporting framework.

Launched in 2000, the CDP initiative encourages companies to disclose their environmental impact. The abbreviation CDP is derived from the words Carbon Disclosure Project, where the organization was founded. CDP reporting collects company-specific information on combating climate change, emissions and adaptation to climate change. By collecting and sharing information, CDP enables the mitigation of investment-related climate risks. As CDP’s investor-signatories, pension providers are directly or indirectly involved in supporting the spread of reporting.

Corporate data collection is supported by more than 700 institutional investors worldwide with total assets of more than USD 140 trillion.

Summarized results of the analysis

The commitment of earnings-related pension funds to the international commitments described above is summarized in the figure below:

Learn more about responsible investment by pension providers

Pension providers explain their own principles and commitments for responsible investment in greater detail on their websites.

- Church Pension Fund

- Elo

- Ilmarinen

- Keva

- Seafarers’ Pension Fund

- The State Pension Fund of Finland

- Varma

- Veritas

Basic information about the analysis

Our analysis of responsible investment reviewed all statutory pension providers, i.e. pension insurance companies, company pension funds, industry-wide pension funds, the Pension Fund for the Employees of Kela, Keva, the Church Pension Fund, Farmers’ Social Insurance Institution, Seafarers’ Pension Fund, the Bank of Finland’s Pension Fund and the State Pension Fund. The results are proportioned to the amount of earnings-related pension assets. The analysis only covers the statutory earnings-related pension provision.

The analysis has been carried out for the first time in 2021.