Weighted index and regional weights

The weighted index, also known as the OLV index, is used for predicting the change in the equity linked buffer. The regional weighting coefficients needed for calculating the OLV index are calculated as descriped on this page.

Content of this page

Weighted index

The weighted index, also known as the OLV index, is used for predicting the change in the equity linked buffer. The return on indices for all areas is calculated by including the income from dividends.

Currency-denominated indices are converted to returns in euros by using the exchange rates of the European Central Bank. The return arisen from the impact of the currency is included in the return percentage of the predictive index. The same currency exchange rate is also used when calculating the realized return on shares. Thus, the same calculation method is used for both the realized and the predictive returns.

The calculation of the predicted index change makes use of the regional division and the corresponding share indices described below.

| Region | Index type | Index name | Bloomberg ticker of the index |

|---|---|---|---|

| 1. Finland | Portfolio return index | OMX Helsinki CAP | HEXYP |

| 2. Europe | Total return index, USD-denominated | MSCI Europe | GDDUE15 |

| 3. USA | Total return index, USD-denominated | S&P500 | SPTR |

| 4. Japan | Total return index, JPY-denominated | Topix | TPXDDVD |

Until the end of year 2015, the index was formed by weighting four share indices calculated for different regions. The calculation of the predicted index change makes use of the regional division and the corresponding share indices described below.

| Region | Index type | Index name | Bloomberg ticker of the index |

|---|---|---|---|

| 1. Finland | Portfolio return index | OMX Helsinki CAP | HEXYP |

| 2. Europe | Price index | MSCI Europe | MSDLE15 |

| 3. USA | Price index, denominated in USD | S&P500 | SPX |

| 4. Japan | Price index, denominated in JPY | Topix | TPX |

Investments in the region “Europe” refer to investments made in the eurozone countries and in Sweden, Denmark, Norway, the United Kingdom and Switzerland. The value of each index is the closing value for the day (note time differences between the regions).

The predicted change percentage

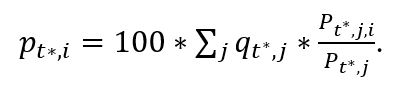

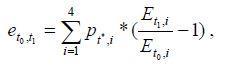

of the index calculated for the period between the times t0 and t1 is obtained by using a formula

where the weight of region i (see numbering above)

is expressed as a percentage point. The weight is determined from data describing the targeting of investments at time t* (see below). Et,i is the value of the share index in region i at time t.

In practice, the most recent weighting coefficients known are from a time not later than the start of the period to be projected. Or when expressed using the symbols above

This is because the final data on the returns on quoted shares for each quarter are received roughly at the same time as the weighting coefficients from the end of the quarter. It is therefore not possible or necessary to use the mean of the weighting coefficients for the start and the end of a quarter, or any other combinations, when the returns, say, for a quarter are predicted.

Regional weights

The regional weighting coefficients needed for calculating the OLV index are calculated as follows.

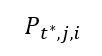

The euro sum of investments in quoted shares made by pension provider j in region i at time t* is represented by

and the total amount of all investments in quoted shares made by pension provider j in the regions 1–4 at time t* is represented by

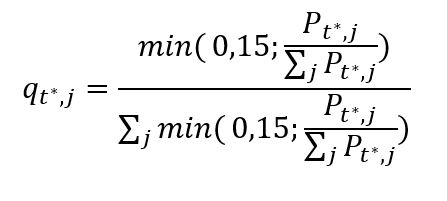

Pension provider j is then given the weight

Lastly, the weighting coefficients of regions as percentage points

are calculated using the formula