Vast majority of pension assets invested responsibly, TELA analysis of international commitments shows: new metric included

A recent analysis conducted by TELA, the Finnish Pension Alliance, shows that the vast majority of Finnish earnings-related pension assets has been invested responsibly. The analysis examines responsible investment against a range of international commitments. Most of the EUR 251 billion in invested assets (at the end of 2023) is used in the promotion of responsible investment projects and cooperation.

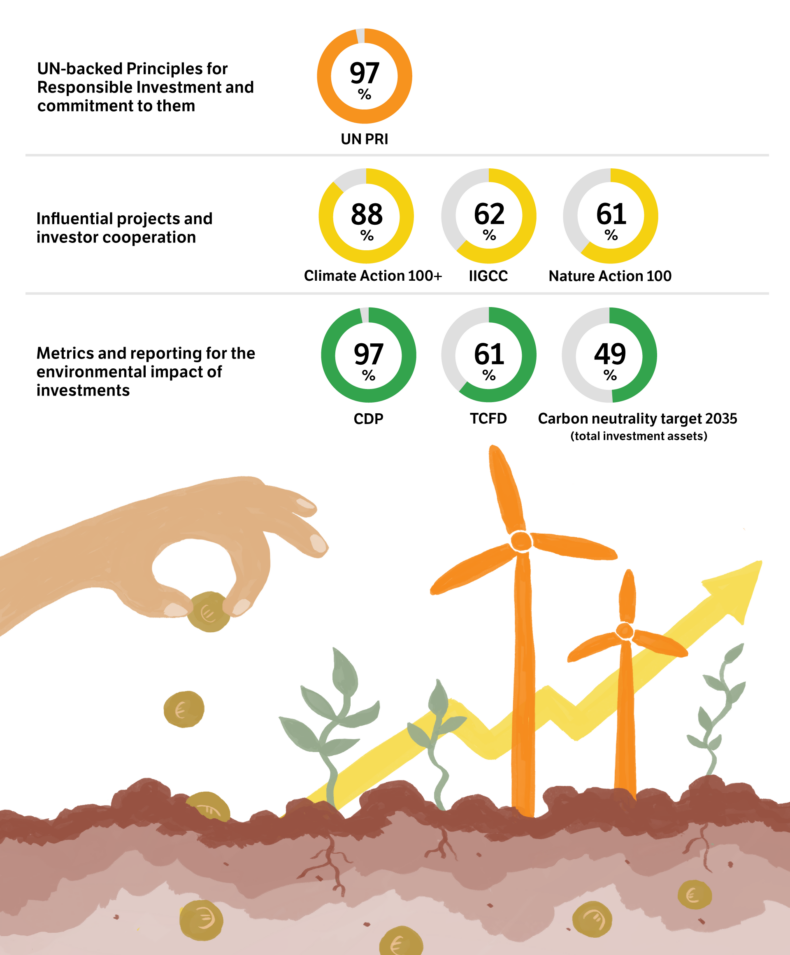

TELA has compiled data on responsible investment in the earnings-related pension sector for the third time. Pension providers invested a total of EUR 251 billion in assets (asset level as of end of 2023). The analysis examines the allocation of assets towards major international responsibility commitments. The commitments and projects chosen for the review shed light on the principles and practice of responsible investment from a range of angles. The figures show how large a share of earnings-related pensions has been invested according to each metric.

“To ensure they’re investing responsibly, Finnish pension providers can use international responsibility commitments, harmonized reporting frameworks and impact initiatives,” Kimmo Koivurinne, an analyst at TELA, says.

Pension providers are involved, either as underwriters or through their external asset managers, in many commitments and active ownership projects which promote responsible investment. Depending on the commitment or project, at least 60–97 per cent of the assets is invested responsibly. One new metric is Nature Action 100, the aim of which is to encourage corporations to act to reverse the depletion of natural habitats. This initiative commits companies to action to end the decline in biodiversity by 2030.

“Preventing the decline in natural environments has risen higher on the responsible investment agenda. To that end, Finnish pension insurers have engaged with commitments such as Nature Action 100. By being part of shared initiatives with large institutional investors, earnings-related pension providers can influence what large companies with high environmental impact do,” Koivurinne says.

At least 61 per cent of pension assets fall under the scope of Nature Action 100. In addition, some of the remaining assets are covered by the initiative via external fund managers used in investment.

“In other respects, the results of the analysis show hardly any change on previous years. Finnish pension providers’ commitment to the reviewed projects has remained at the same level. In addition to these projects, pension providers conduct a range of sustainable investment projects. They set new targets for their investments every year. The sustainable development toolbox is constantly expanding,” Koivurinne says.

Analysis result summary

The analysis examines how responsibly assets are invested from three perspectives. In addition to the UN-supported Principles for Responsible Investment (PRI) framework, it uses a range of significant international investment impact projects and commitments to the measurement and reporting of environmental impact. That allows for a sufficiently broad picture of the goals and practical implementation of sustainable investment in the earnings-related pension system.

1 Based on the UN-supported PRI

The UN-supported PRI framework is the most significant international commitment and the basis for the responsible investment of earnings-related pension assets. Almost 97 per cent of pension assets are invested according to the PRI framework. This includes the seven largest earnings-related pension providers and equals EUR 242 billion of the EUR 251 billion of pension assets (asset amounts as of end of 2023). In addition, some of the remaining assets are covered by the PRI framework via external fund managers used in investment. They are required to commit themselves to PRI.

PRI means a pledge to ensure that investment respects the environment, social responsibility and good governance (ESG). Data on ESG are systematically applied when forming investment analyses and decisions.

2 Investor cooperation and impact

Because they invest globally, earnings-related pension providers make an impact on their investments with the help of international commitments. Investors use them to join forces to influence companies.

- Institutional Investors Group on Climate Change (IIGCC): a collaborative body of European pension investors and institutional asset managers for the mitigation of climate change. At least 62 per cent of assets fall directly or indirectly under the scope of this project.

- Climate Action 100+: an international project which makes an impact on the operations of the large corporations with the largest environmental footprint. At least 88 per cent of pension assets fall directly or indirectly under the scope of this project.

- Nature Action 100: an international investors’ initiative which aims to raise companies’ ambition and action to reverse biodiversity loss. This initiative commits companies in key industries to action towards ending the decline in biodiversity by 2030. At least 61 per cent of pension assets fall directly or indirectly under the scope of this initiative.

Some of the remaining assets are involved in projects via external fund managers used in investment.

3 Measurement and reporting of investments’ environmental impact

International measurement and reporting commitments are another way to make an impact. The measurement and reporting of environmental impacts are the first steps required of companies. They allow for the charting and further monitoring of companies’ responsibility efforts. Requiring companies to report encourages them to reduce their carbon footprint and other environmental impacts. That influences not only the operations of companies which are the object of investments but also the corporate world more broadly. Earnings-related pension providers use such reports when planning how to invest responsibly.

- CDP reporting: CDP reporting, begun in 2000, encourages companies to publish their environmental impacts and evaluate the risks and opportunities of their business operations on that basis. The abbreviation stands for Carbon Disclosure Project, the first iteration of the organization. At least 97 per cent of assets are covered directly or indirectly by the investors’ status as an investor-signatory to CDP, thus supporting the spread of reporting. In addition to a direct commitment, some of the remaining assets are involved in the project via external fund managers used in investment.

- Recommendations of the Task Force on Climate Related Financial Disclosures (TCFD): The TCFD reporting framework, established in 2017, steers companies towards reporting on climate-related financial risks and opportunities. At least 61 per cent of assets fall directly or indirectly under the scope of this framework. In addition to a direct commitment, some of the remaining assets are involved in the project via external fund managers used in investment.

- Carbon-neutrality target by 2035 for all investments: In addition to these commitments, earnings-related pension providers are guided by their own responsibility principles and goals. They could relate to certain asset classes, or the reduction of the carbon footprint of the entire portfolio. The most ambitious goal in international terms is the carbon neutrality of all investment property by 2035. As a ratio of the amount of assets, 49 per cent of pension assets have such a goal. In addition, the goal for some assets is climate neutrality by 2050 in accordance with the Paris Agreement on climate change.

The figure shows the results of the analysis.

**

The TELA analysis of responsible investment includes all statutory earnings-related pension providers, that is, pension providers, pension funds, pension foundations, the Pension Fund for the Employees of KELA, KEVA, the Church Pension Fund, the Farmers’ Social Insurance Institution, the Seafarers’ Pension Fund, the Bank of Finland’s Pension Fund, and the State Pension Fund of Finland. The results are proportionate to the amounts of pension assets. Only statutory pension coverage is included in the analysis. For full, detailed information on responsible investment commitments, see the Responsible Investment page on the TELA website, as well as pension providers’ websites.