Most earnings-related pension assets invested responsibly

Our recent analysis shows that the vast majority of Finnish earnings-related pension assets has been invested responsibly. The analysis examines responsible investment against a range of international commitments. Most of the 238 billion euros in invested assets is used in the promotion of responsible investment projects and cooperation.

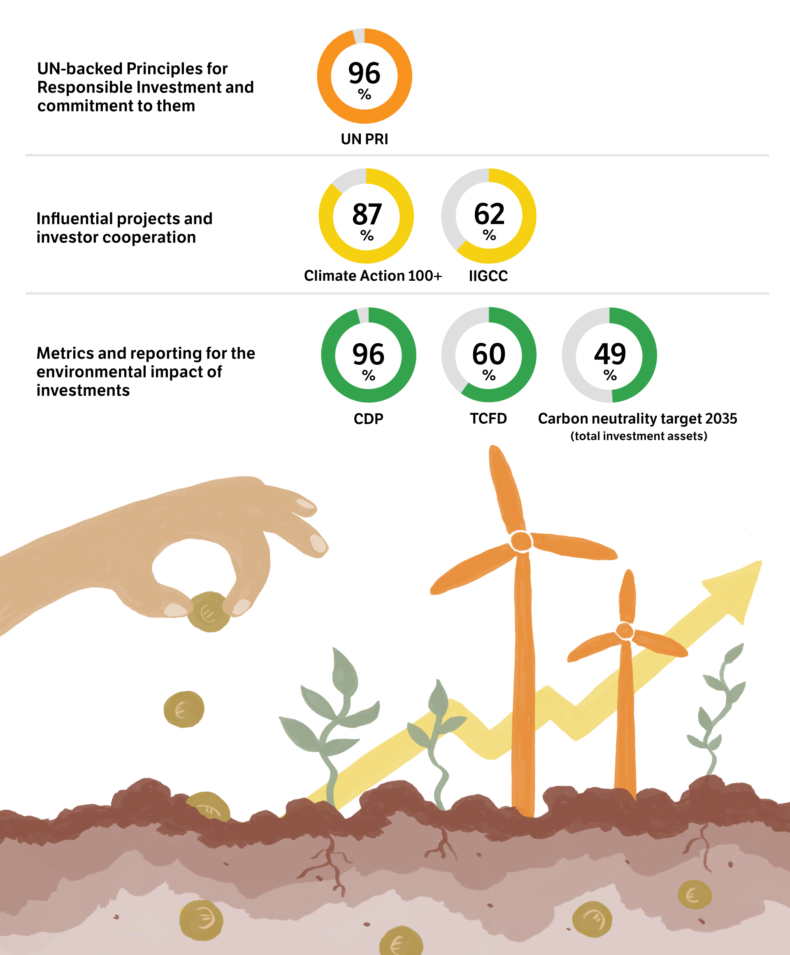

We have now collected data on responsible investment in the earnings-related pension sector for the second time. Pension providers invested a total of 238 billion euros in assets (asset level as of end of 2022). The analysis examines the allocation of assets towards major international responsibility commitments. The commitments and projects chosen for the review shed light on the principles and practice of responsible investment from a range of angles. The figures show how large a share of earnings-related pensions has been invested according to each metric.

“An extensive toolbox is available for the responsible investment of earnings-related pension assets. Most pension assets are invested in on the international markets, and the share of investments in Finland is less than a quarter nowadays. To ensure they’re investing responsibly, Finnish pension providers can use international responsibility commitments, reporting frameworks and investors’ joint initiatives,” our analyst Kimmo Koivurinne says.

Pension providers are involved, either as underwriters or through their external asset managers, in many commitments and active ownership projects which promote responsible investment. Depending on the commitment or project, at least 49–96 per cent of the assets is invested responsibly.

“The results of the analysis do not show a change on the year before. Finnish pension providers’ commitment to the reviewed projects has remained the same. However, the major pension providers have supplemented their responsible investing toolboxes with projects and goals concerning individual asset classes, such as property investments,” Koivurinne says.

UN-backed Principles for Responsible Investment are the base

The analysis examines the responsibility of investing assets from three perspectives.

“The UN-backed Principles for Responsible Investment are the most important international commitment, and are the base for the responsible investment of earnings-related pension assets. Almost all earnings-related pension assets are invested in line with these principles,” Koivurinne says.

At least 96 per cent of earnings-related pension assets have been invested in line with the UN’s Principles for Responsible Investment. This means 229 billion euros out of a total of 238 billion euros in earnings-related pension assets (amount at the end of 2022). In addition, some of the assets fall within the scope of the principles through the external asset managers used in investment activities, who are required to commit to the principles.

The principles mean that investment activities are committed to caring for the environment, social responsibility and good governance — the ESG factors. ESG data are utilized systematically when making investment analyses and decisions.

Impact through initiatives and cooperation and through measurement and reporting

The other two ways of implementing responsible investment, examined in the analysis, are influencing investment targets and investor cooperation, and measuring and reporting environmental impacts.

“Besides the Principles for Responsible Investment (PRI) backed by the UN, for making the analysis we chose various significant influential international projects and environmental impact measurement and reporting commitments. This gives a sufficiently diverse picture of the goals of responsible investment and its practical implementation in the earnings-related pension system,” Koivurinne explains.

When the scale is global, authorized pension providers have an impact on investment targets through international commitments. These allow investors to join forces to influence companies.

“By participating in joint initiatives of large institutional investors, such as the Climate Action 100+ project that originated in the Paris Agreement of 2015, authorized pension providers can influence the operations of large companies that have major environmental impacts,” Koivurinne states.

At least 87 per cent of earnings-related pension assets fall within the scope of the Climate Action 100+ initiative. 62 per cent of the assets fall within in the scope of the Institutional Investors Group on Climate Change, another international body combating climate change. In addition, some of the assets fall within the scope of these commitments through the external asset managers used for investment activities.

International measurement and reporting commitments are also a way to make an impact.

“Measuring and reporting environmental impacts are the first steps required in order to gain a picture of the state of corporate responsibility and to monitor developments. Requiring reporting encourages companies to reduce their carbon footprint and other environmental impacts. In this way, both the companies in which investments are made and the wider corporate world are influenced. Authorized pension providers use such information when planning responsible investment,” Koivurinne says.

The two reporting commitments selected for review (CDP and TCFD) cover 60 per cent and 96 per cent of pension assets, respectively. In addition to direct commitments, some of the assets are incorporated in projects through the external asset management used for investment activities.

Besides commitments, authorized pension providers’ investment activities are steered by their own responsibility principles and objectives, for instance in order to reduce the carbon footprint of a certain property type or the entire investment portfolio. At present, 49 per cent of pension assets are covered by the carbon-neutral goal for all investment property set for 2035. The goal is ambitious by international standards. What’s more, in line with the Paris Climate Agreement, some of the assets have the goal of carbon neutrality by 2050 at the latest.

At the heart of security

Responsibility has long been the mainstream of investment, and this is the case also for authorized pension providers’ investment activities.

“By law, pension assets must be invested profitably and securely. In the pension system, the sights are automatically far in the future, as assets and income must be sufficient for pensions in decades to come. Investments whose climate and environmental impacts are sustainable can therefore be seen as one aspect of that security. In addition, the systematic consideration of responsibility factors in investment activities helps with the risk management of investments; in other words, responsibility also brings short-term security,” Koivurinne explains.

The figure shows the results of the analysis.

1 UN-backed Principles for Responsible Investment

- The UN-backed Principles for Responsible Investment constitute the base for the responsible investment of earnings-related pension assets. At least 96 per cent of the assets are invested in line with these principles.

2 Impact and investor cooperation

- Climate Action 100+ project: This is an international project that affects the operations of large companies with the most significant environmental impact. At least 87 per cent of pension assets fall within the scope of the project directly or indirectly.

- Institutional Investors Group on Climate Change (IIGCC): This is a body for collaboration between European pension investors and institutional asset managers with a view to curbing climate change. At least 62 per cent of assets fall within its scope directly or indirectly.

3 Measuring and reporting the environmental impact of investments

- CDP reporting: CDP reporting, launched in 2000, encourages companies to disclose their environmental impacts and to evaluate the risks and possibilities of their business from that basis. The acronym CDP comes from the words Carbon Disclosure Project, where the organization got its start. At least 96 per cent of assets fall within its scope directly or indirectly.

- Task force on Climate Related Financial Disclosures (TCFD): Established in 2017, the international reporting framework guides companies to disclose climate-related financial risks and possibilities. At least 60 per cent of assets fall within its scope directly or indirectly.

- Carbon neutrality goal for all investment property by 2035: Investment activities are also guided by authorized pension providers’ own responsibility principles and goals. The most ambitious of these goals is carbon neutrality for all investment property by 2035. Proportioned to the amount of assets, 49 per cent of pension assets have this goal.

Our analysis of responsible investment considered all statutory earnings-related pension providers — pension insurance companies, industry-wide pension funds, company pension funds, the pension liability fund for employees of the Social Insurance Institution Kela, Keva, the Church Pension Fund, the Farmers’ Social Insurance Institution (Mela), the Seafarers’ Pension Fund, the Bank of Finland’s Pension Fund and the State Pension Fund.

The results are proportioned to the amount of earnings-related pension assets. The analysis only covers the statutory earnings-related pension provision. More detailed information on responsible investment commitments can be found on our website: